corporate tax malaysia 2019

Tax incentives can be granted. Malaysia has a wide variety of incentives covering the major industry sectors.

Malaysian Tax Issues For Expats Activpayroll

Financial Services Government and Public Sector Oil and Gas Technology Media and.

. Not only has the corporate tax rate been decreased over the years the government. 20222023 Malaysian Tax Booklet. Dari luar Malaysia bagi syarikat insurans pengangkutan laut dan udara dan perbankan sahaja.

Corporate - Tax credits and incentives. Last reviewed - 13 June 2022. For both resident and non-resident companies corporate income tax CIT is imposed on income.

The Corporate Tax Rate in Malaysia stands at 24 percent. Resident companies are taxed at the rate of 24 while those with paid-up capital of RM25 million or less and gross business income of not more than RM50 million. Doing business in Malaysia 2022.

Reduction of corporate tax rate for small medium enterprises SMEs on chargeable income of up to RM 500000 to 17 from 18 effective from YA 2019. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara. The standard Malaysia corporate tax rate is of 24 for the financial year of 2019-2020 this rate being applied to both resident companies and to non-resident companies.

However if you qualify as a small medium enterprise SME the first. Corporate - Taxes on corporate income. Assessment Year 2018-2019 Chargeable Income.

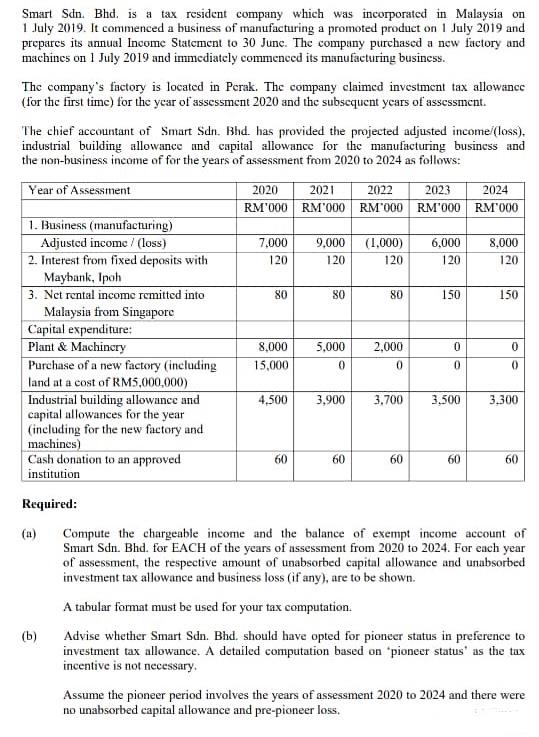

Corporate Tax Rate in Malaysia averaged 2604 percent from 1997 until 2022 reaching an all time high of 30 percent in 1997. Tax Rate of Company. The corporate tax rate has decreased from 40 in the late 1980s to the current rate of 24.

Resident companies are taxed at the rate of 24. However Malaysia offers a multitude of tax exemptions under the ITA and the Promotion of Investments Act 1986 PIA which exempt either the entirety of the income of an entity from. Company Resident Status.

A Company in Malaysia is subject to income tax at the rate of 24 based on law stated as at 2019. Company Taxpayer Responsibilities. With our Malaysia corporate income tax calculator you will be able to get quick tax calculation adjustments that help you to estimate and accurately forecast your tax payable amounts.

For small and medium enterprise SME the first RM600000 Chargeable Income will be tax at 17 and the Chargeable Income. Calculations RM Rate TaxRM 0 - 5000. Last reviewed - 13 June 2022.

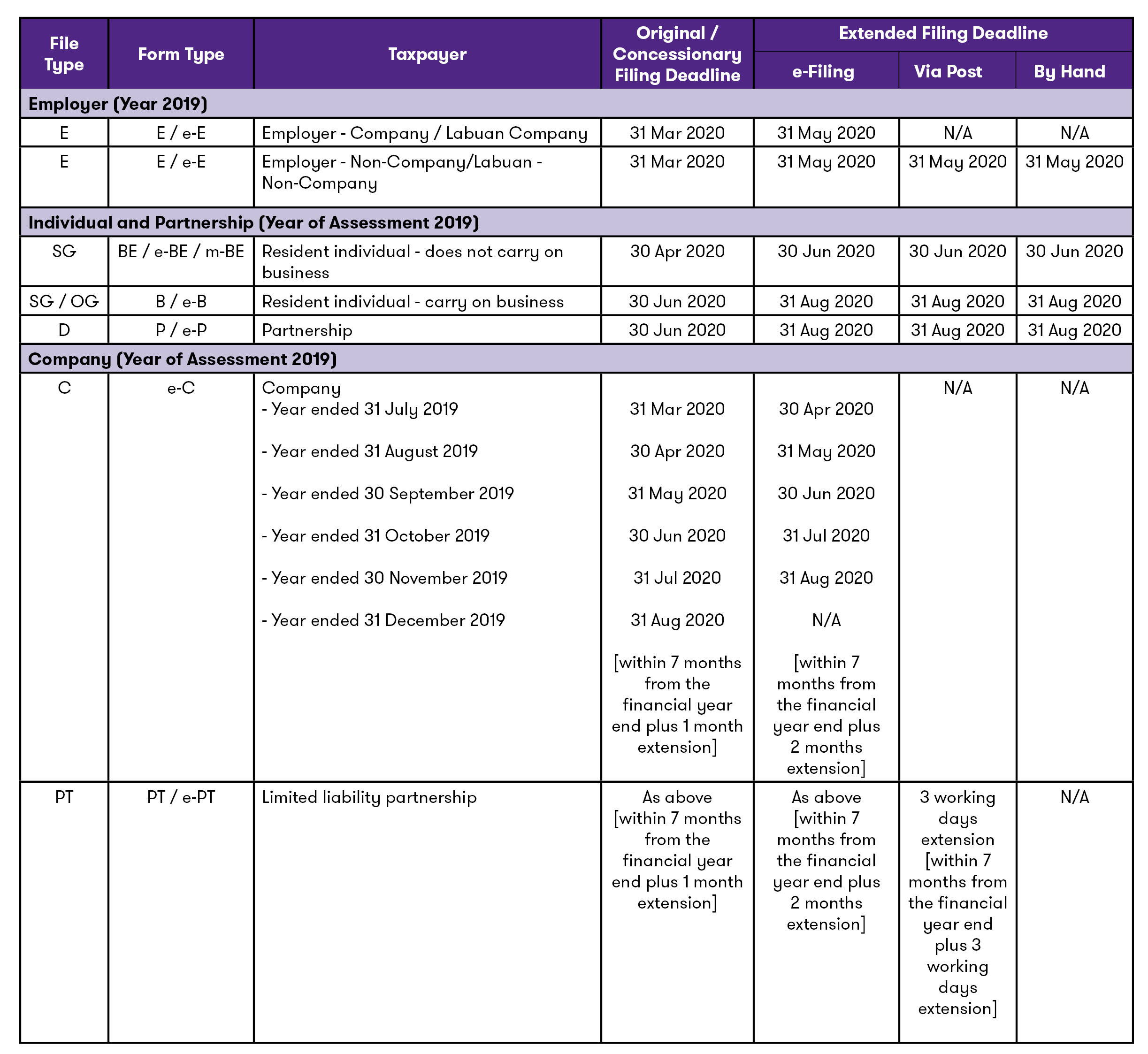

Extension Of Various Tax Deadlines Grant Thornton Malaysia

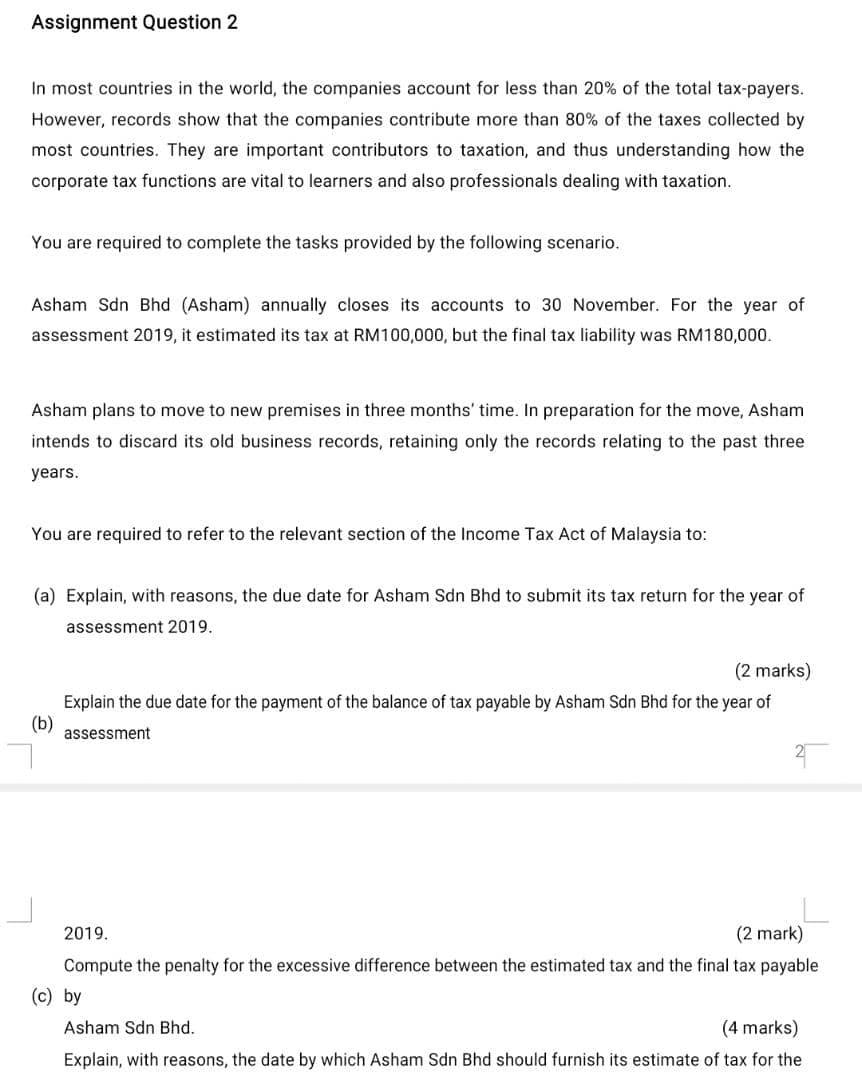

Assignment Question 2 In Most Countries In The World Chegg Com

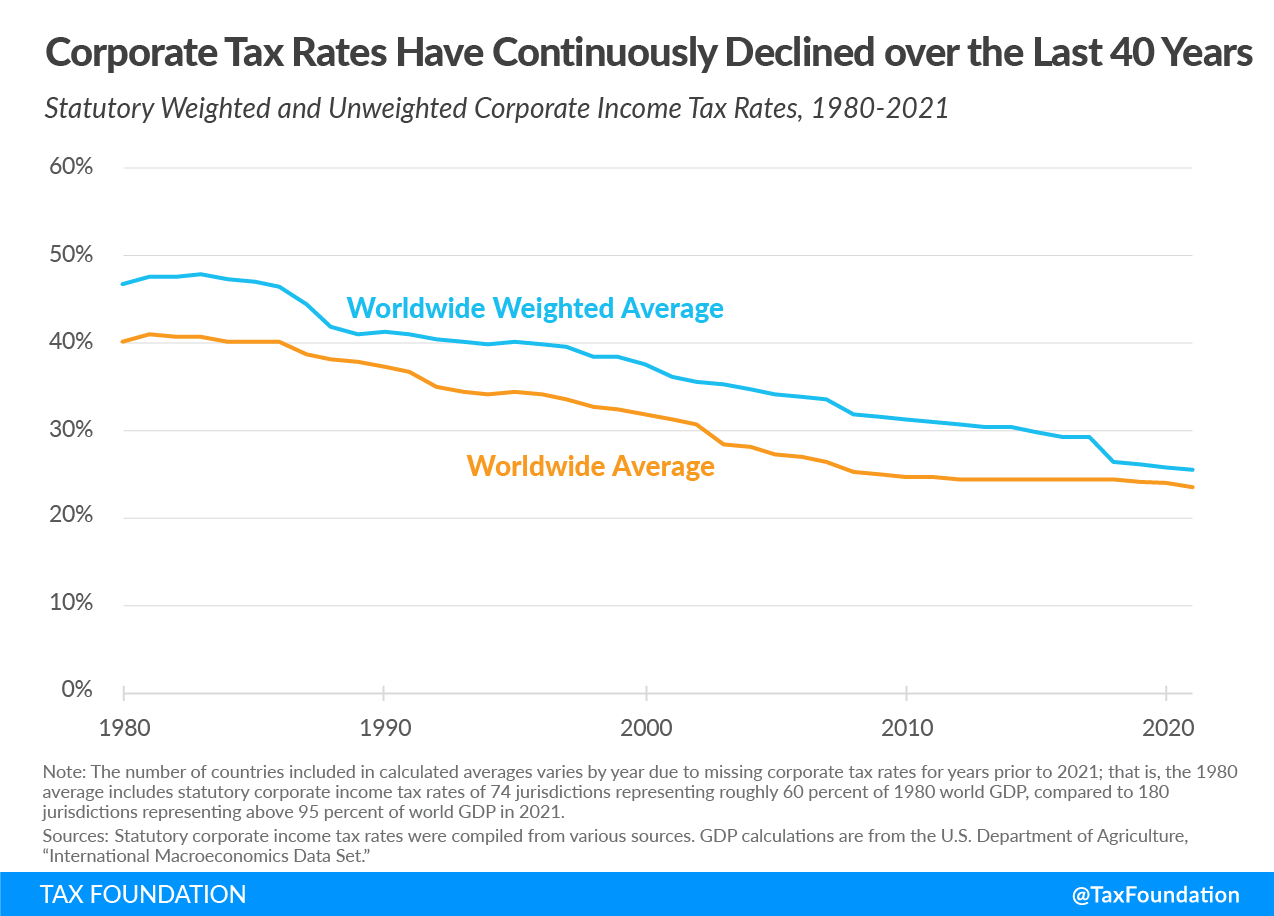

Smart Sdn Bhd Is A Tax Resident Company Which Was Chegg Com

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

Malaysia Institutes Up To Rm150 Departure Tax Effective September 1 2019 Loyaltylobby

Income Tax Rate Comparison Between Malaysian Singaporean R Malaysia

Malaysia Personal Tax Relief Ya 2019 Cheng Co Group

Corporate Tax Rates Around The World Tax Foundation

Corporate Tax Rates Around The World Tax Foundation

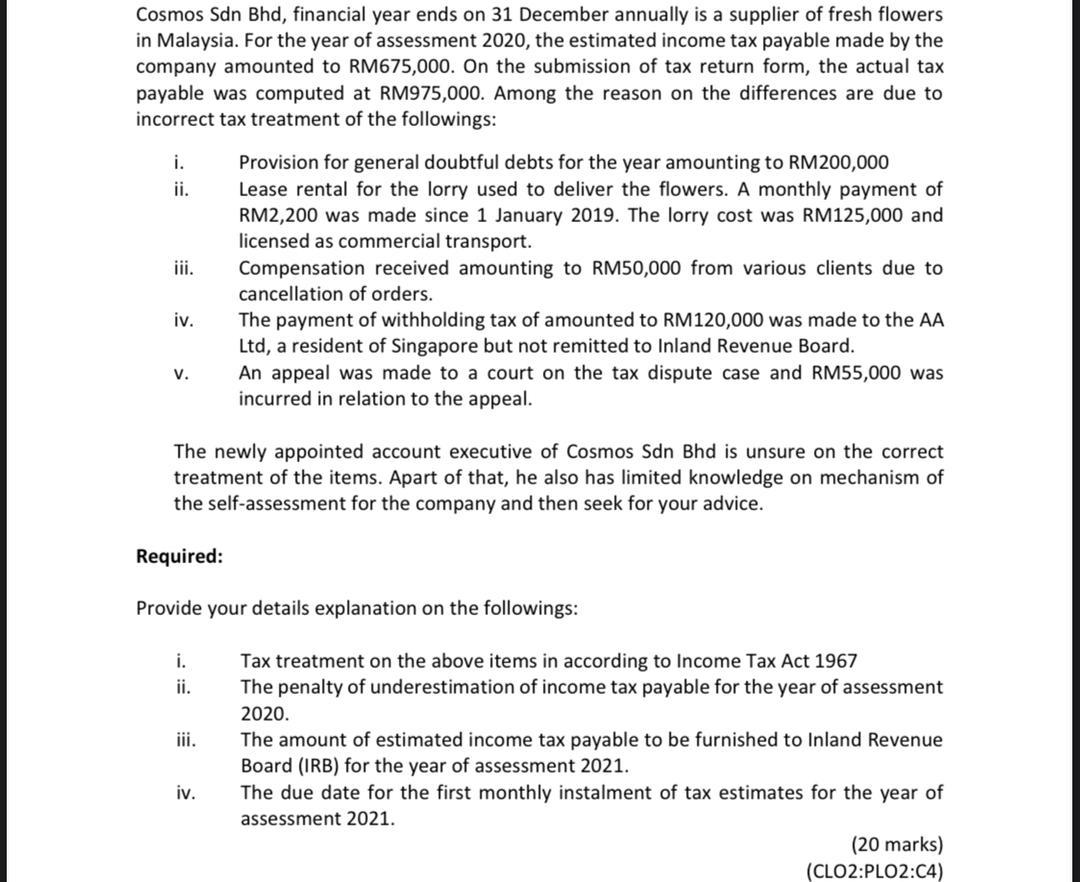

Solved Cosmos Sdn Bhd Financial Year Ends On 31 December Chegg Com

Real Property Gains Tax Rpgt In Malaysia 2022

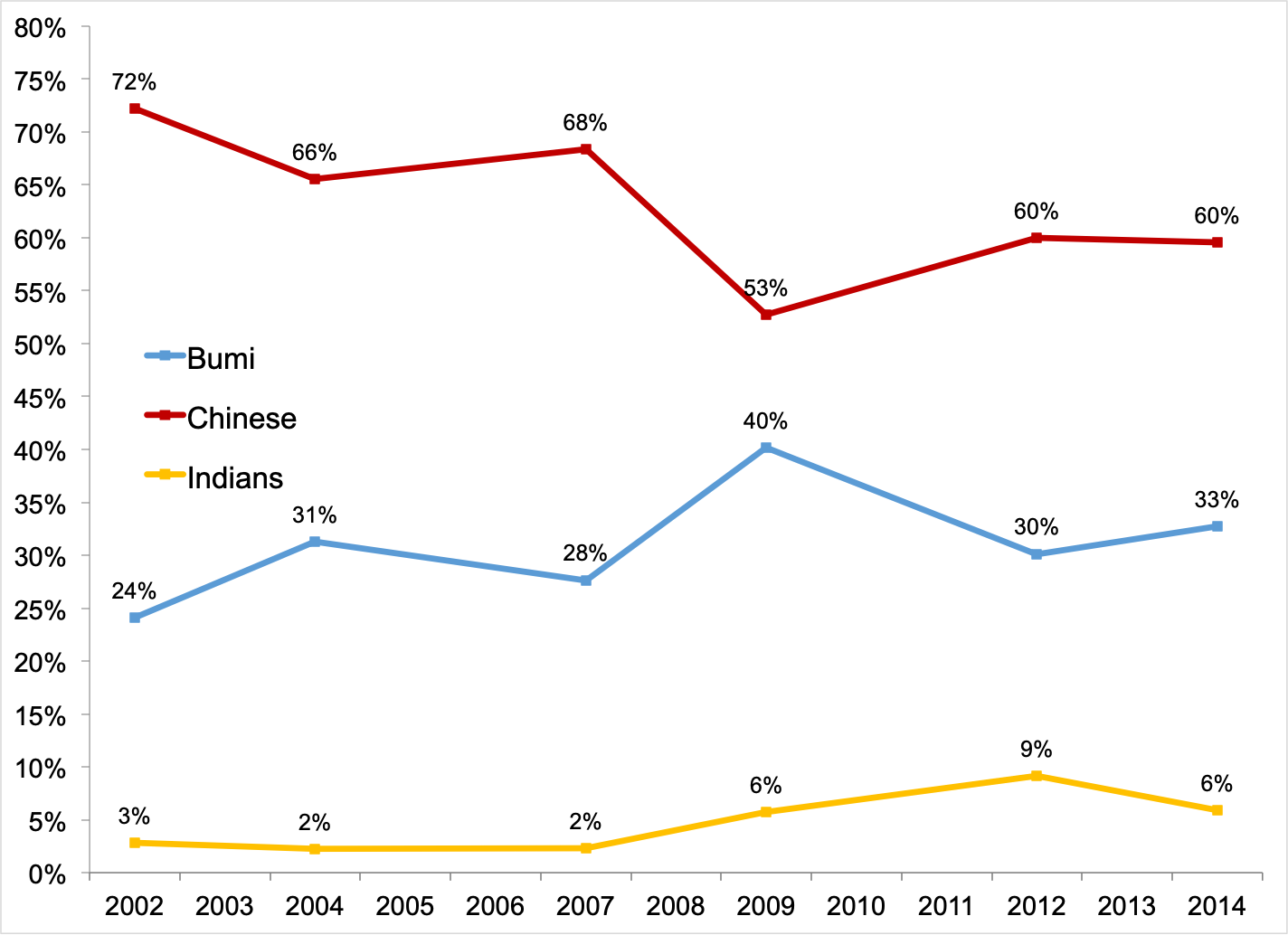

Income Inequality Among Different Ethnic Groups The Case Of Malaysia Lse Business Review

Ebit Of Italian Footwear Company Geox 2017 2019 Statista

Newsletter 39 2019 Income Tax Exemption No 8 Order 2019 Page 001 Jpg

2017 Personal Tax Incentives Relief For Expatriate In Malaysia

Income Tax Malaysia A Definitive Guide Funding Societies Malaysia Blog

Pdf Journal Of Finance And Banking Review A Theoretical Review On Corporate Tax Avoidance Shareholder Approach Versus Stakeholder Approach Gatr Journals Academia Edu

Comments

Post a Comment